Call Me BEFORE Listing Your Home!

You Know What They Say About Assumptions!

If you are thinking about selling your existing property and financing a new one, you should really consider contacting me BEFORE you list your current property. No, I’m not a Real Estate Agent, and I don’t want to list your property for you, I am your mortgage broker and I simply want to make sure that you are going to qualify for your next purchase BEFORE you go and sell your existing property. Because I would hate to see you end up homeless.

Now, if this sounds like common sense to you, perfect, I expect your call, but if you are wondering why you should call me first, you are most likely making the assumption that because you qualified for a mortgage before, you will qualify again. Unfortunately, not so. Over the past couple of years there have been many changes to how people qualify for a mortgage and lots of products and programs have been eliminated or scaled back.

Mortgage qualifications and lender guidelines simply aren’t what they used to be. It’s a lot harder to get a mortgage now in 2015 than it was back in 2010-2014. Don’t just assume you will qualify for a mortgage going forward, start the process by talking with me!

Even if your financial situation has only improved since you secured your last mortgage, there is still a chance you might not qualify going forward. The key is simply having a look and developing a plan. I am always available to you in order to sit down and take a look at your numbers.

Taking the time to meet with me at the very beginning will ensure that you don’t start down a path and get blindsided by your assumptions.

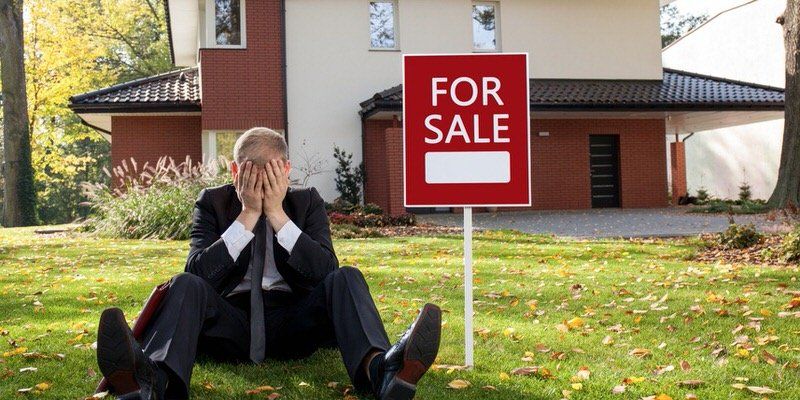

Of course the worst case scenario would be for you to sell your existing home believing that you will qualify for a mortgage going forward just to realize that you can’t, and it’s too late, you no longer have a home. Or even if you were to start shopping for a property (before selling your existing), just to find your dream house, put in an offer only to realize that you no longer qualify for financing and you have to back away from the purchase. That is heartbreaking! I assure you, although these scenarios may seem to be far fetched, they are more commonplace than you would think.

The truth is, people only know what they know, and the combination of rule changes and assumptions in mortgage qualification can be very dangerous. Most people only care about mortgages every 3-5 years, there is no need for them to stay current with lender guidelines. However I do this every day, so please put my experience to work for you.

Now, chances are you will most likely qualify for a new mortgage, but I can’t stress enough the importance of having a plan from the start… and who knows, maybe I can even help you figure out the best way to proceed by shining light on options you might not have even known existed to you.

Let me finish with this… if you are thinking of selling your existing home to buy something new…

Let’s work through all the numbers together and put a plan together before you go and list your property and end up homeless.

Katherine Martin

Origin Mortgages

Phone: 1-604-454-0843

Email: kmartin@planmymortgage.ca

Fax: 1-604-454-0842

RECENT POSTS